Introduction

The supply chain is the most crucial for any business. The key factor for a successful business operation is efficient and transparent communication and collaboration with the supply chain. Businesses have already started to integrate business processes with tech-driven processing solutions to have automation in their supply chain to improve the workflow and cash flow of the organization.

The business has adopted automation in invoicing, payroll, payments, receipts, day-to-day accounting, reporting, and preparation of financial statements. Now to add fuel to the digitization and automation, the government introduced the issuance of e-invoicing under the GST Act. The invoice process automation and e-invoicing under GST will help to digitalize the supply chain which in the future may result in the emergence of more innovative trade finance schemes.

e-invoicing in the supply chain is revolutionizing how businesses manage their financial and compliance operations within the supply chain. They not only streamline the invoicing process but also introduce new dimensions in supply chain relationship enhancement and financing.

To understand how e-invoicing helps in the supply chain, it is crucial to understand what supply chain and e-invoicing are.

Supply Chain: An Overview

A supply chain is the group or network of organizations, individuals, technologies, resources, activities, etc. working in the creation and supply of products. It is a chain from the supply of raw materials to the manufacturer to the supply of finished products to the end user. It mainly has two channels, production, and distribution.

Why understanding the supply chain is crucial for the business?

The supply chain is important for making financial decisions and strategic planning to streamline procurement to the payment process.

Mapping of the supply chain helps businesses decide their place in the market and where they want to reach over a period of time.

Clearly outlining the supply chain helps businesses understand the individuals or organizations involved at different stages of the chain and provides insights to improve business and relationships with such stakeholders.

Understanding e-invoicing

In general terms, e-invoicing, or electronic invoicing, is the digitization of the invoicing process. Instead of generating and exchanging paper invoices, e-invoicing involves creating, sending, receiving, and processing invoices in electronic format. Various invoice processing software helps businesses streamline and automate invoice processing; however, collaborative invoicing solutions are crucial for the organization.

A collaborative invoicing solution is a specialized software e-invoicing platform that facilitates collaborative invoicing and payment processes between businesses, suppliers, and customers. It goes beyond traditional invoicing systems by enabling multiple stakeholders to work together in a coordinated manner to streamline invoice creation, approval, and payment workflows.

Now let’s understand how e-invoicing in the supply chain, and collaborative invoicing solutions help supply chain managers enhance the supply chain relationship.

e-invoicing in Supply Chain

e-invoicing is an invaluable asset in modern supply chain management. Automating the process has slashed time-consuming manual tasks, reduced errors, and delays, and expedited the payable and receivable cycle with transparency and accuracy along with the fulfillment of e-invoicing compliance standards.

Further, the introduction of e-invoicing by the government under the GST Act has acted as the cherry over the cake which provides authentication to the information of the invoices issued by the supplier in its digital invoice system, and the said information after authentication can also get transferred to other GST portals and auto-populate the information which makes data more trustworthy and accurate.

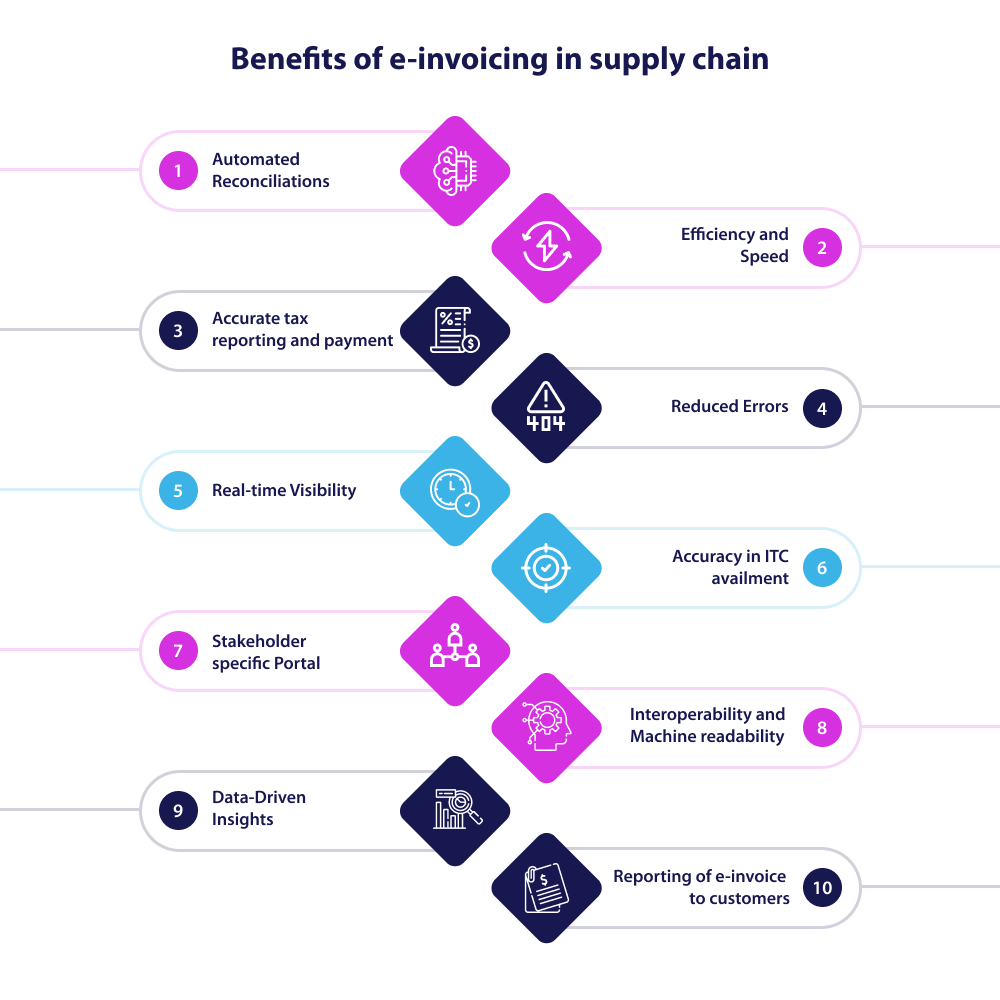

Here are the benefits that the supply chain can have with the implementation of e-invoicing:

- Efficiency and Speed: e-invoicing accelerates the invoicing process by automating various tasks such as invoice creation, validation, and approval. This efficiency leads to faster payments and improved cash flow for suppliers, which in turn strengthens relationships for businesses.

- Reduced Errors: Digital invoices are generated electronically, minimizing data entry errors. Further, after its generation the invoices are authenticated on a government portal i.e., IRP (Invoice Registration Portal) which helps in mitigating error or fraud, and the information provided is more accurate and helps in building trust and reputation of the business.

- Accuracy in ITC availment: The information of e-invoice authenticated in IRP flows to the GST portal to get GSTR-1 auto-populated without the need for manual entry which increases its accuracy and according to the entries reflected in GSTR-2A/2B is accurate for ITC availment by the recipient which helps in maintaining a good relationship with the stakeholders.

- Interoperability and Machine readability: The e-invoices to be validated by the government have a standard format that has all the required information.

Further, the format is machine-readable and interoperable, which helps in accessing e-invoices easily by any authorized person or required stakeholder in its system without any need for a connector.

By this, e-invoices generated by one software can be read by any other software, thereby eliminating the need for fresh/manual data entry or connector.

- Reporting of e-invoice to customers: Once IRP authenticates the invoices the said digitally signed e-invoices with unique IRN and QR codes can be shared with the customer if the E-mail of the customer is mentioned in it.

This helps in the timely communication of e-invoice verification by the government which ensures the reflection of the customer’s purchase entry in its GSTR-2A/2B.

- Automated Reconciliations: The integration of digital invoice system or solution, ERPs of business and government portals can automatically fetch required data to reconcile various transactions reported in GSTR-1, GSTR-3B, GSTR-2B books of accounts, etc. which helps in solving and reducing reconciliation gaps quickly and comply with the law with more accurately thereby maintaining the reputation and trustworthiness among the supply chain.

- Accurate tax reporting and payment: Since the automated solutions and flow of information by IRP provide accuracy in filing various returns and documents, the tax reported and paid will be correct and accurate which in turn will help recipients to avail ITC without any dispute thereby fostering the collaborative relationship.

- Real-time Visibility: e-invoicing allows businesses to have real-time visibility into their invoice status, payment schedules, and transaction history. All parties involved can track the progress of invoices from creation to final settlement.

This transparency enables the financial departments of stakeholders to anticipate prospective inflows or outflows of money and make plans accordingly.

- Stakeholder-specific Portal: The automated billing solution provides a portal where suppliers can log in to the dedicated portal to submit invoices, and check approval and payment status at the same time customers can check the goods in transit status, deposit of tax to the department or any other information required to avail ITC or comply with any rules, regulations or standard.

It also provides communication features that allow stakeholders to communicate directly in case of any query or doubt within the system, eliminating the need for external emails and phone calls.

- Data-Driven Insights: The digital nature of e-invoicing enables the generation of data that can be analyzed by businesses to identify market trends, optimize processes, and make informed decisions in terms of cash flow management. This data-driven approach also enhances collaboration by facilitating strategic discussions among stakeholders.

In conclusion, e-invoicing is continuously reshaping the supply chain management landscape by enhancing collaboration between suppliers and buyers. Its ability to streamline processes, reduce errors, provide real-time visibility, and drive cost savings makes it necessary in today’s fast-paced business environment. By embracing e-invoicing and integrating it into their operating systems, companies can cultivate stronger partnerships in the market, foster innovation in their firms, and ultimately achieve a more efficient and resilient supply chain ecosystem in the long term.